does fla have an estate tax

You should also be aware of federal estate taxes or estate taxes charged. Floridians like most everyone around the world pay taxes.

Florida Real Estate Taxes What You Need To Know

Figuring out the amount of your doc stamps.

. Florida Estate Tax. Federal government does have an estate tax. The majority of US.

Floridas general state sales tax rate is 6 with the following exceptions. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. The bad news is however that the US.

There are no inheritance taxes or estate taxes under Florida law. Florida doesnt have a personal income tax nor does it have an estate tax or an inheritance tax. This applies to the estates of any decedents who have.

A federal change eliminated Floridas estate tax after December 31 2004. Previously federal law allowed a credit for state death taxes on the federal estate tax. It does however impose a variety of sales and property taxes and some are.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance. States Florida included do not levy a tax on estates though the federal government does if the estate is large enough.

Property taxes apply to both. The good news for Florida residents is that there is no such thing as estate tax under Florida law. Florida also does not collect an.

Applicants have two options to apply. Tax amount varies by county. In Florida transfer taxes are also referred to as documentary stamps or doc stamps and theyre typically paid by the seller.

The state constitution prohibits such a tax though Floridians. Florida residents no longer have to pay a Florida estate tax but there are forms you may need to fill out. Florida is one of a few states that does not have state income tax making the state a popular place to retire.

Florida property owners have to pay property taxes each year based on the value of their property. Does Florida Have an Inheritance Tax or Estate Tax. What is the Florida property tax or real estate tax.

097 of home value. The strength of Floridas low tax burden comes from its lack of an income tax making them one of seven such states in the US. To apply for a resale certificate you need to file Form DR-1 Florida Business Tax Application with the Florida Department of Revenue.

3 Florida Estate Planning Documents You Need Right Now Florida Estate Planning Florida Probate Florida Real Estate Florida Bankruptcy And Tax Attorneys

Snowbird Bill Would Double The Mass Estate Tax Exemption

In Florida Homeowners Come For The Weather And Stay For The Tax Relief Wsj

The Complete Guide To Planning Your Estate In Florida A Step By Step Plan To Protect Your Assets Limit Your Taxes And Ensure Your Wishes Are Fulfilled For Florida Residents Ashar Linda C 9781601384287

2022 Real Estate Tax Conference Tax Section Of The Florida Bar

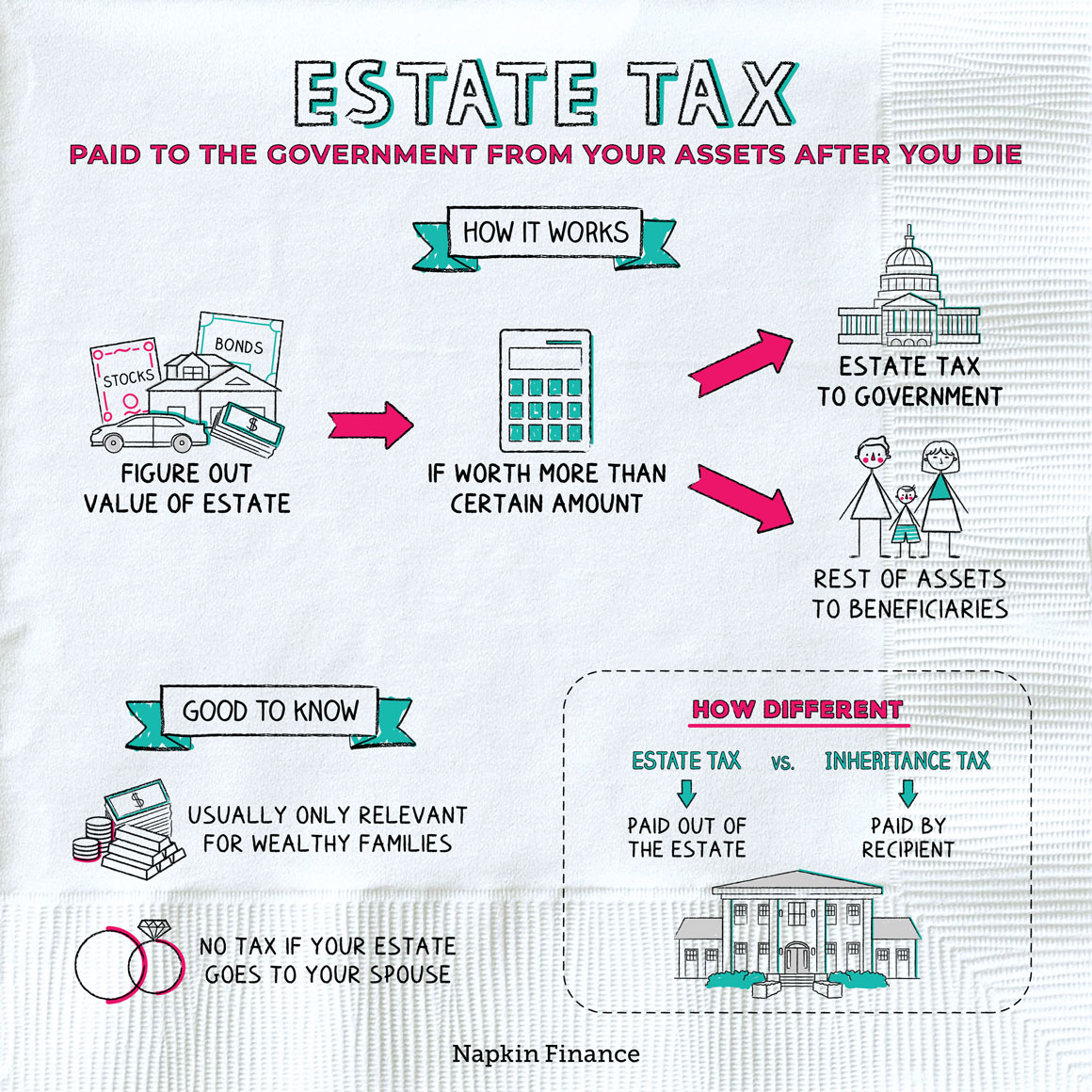

What Is An Estate Tax Napkin Finance

Florida Estate Tax Rules On Estate Inheritance Taxes

Minnesota S Wealthy Caught In A Tight Tax Net Over Residency

What Taxes Do I Have To Pay If I Receive An Inheritance In Florida St Lucie County Fl Estate Planning Attorneys

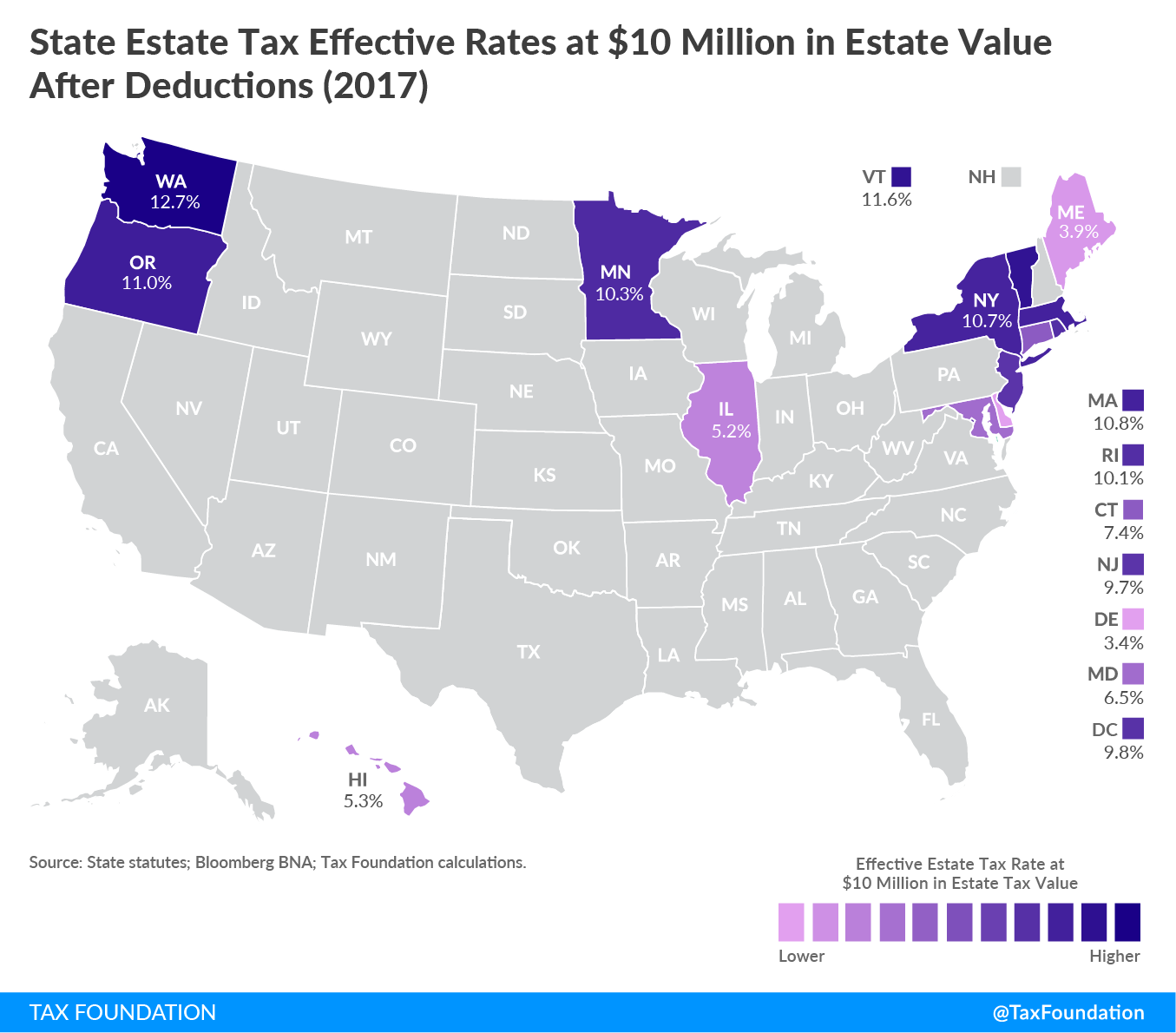

16 States You Don T Want To Die In Florida Estate Planning Lawyer Blog January 23 2009

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Tax Secrets Lifetime Planning Wins The Estate Tax Game

Do I Have To Pay Federal Estate Tax From My Inheritence

Does Florida Have An Inheritance Tax Doane And Doane P A

Free Florida Small Estate Affidavit Pdf Eforms

Dr 312 2002 Form Fill Out Sign Online Dochub

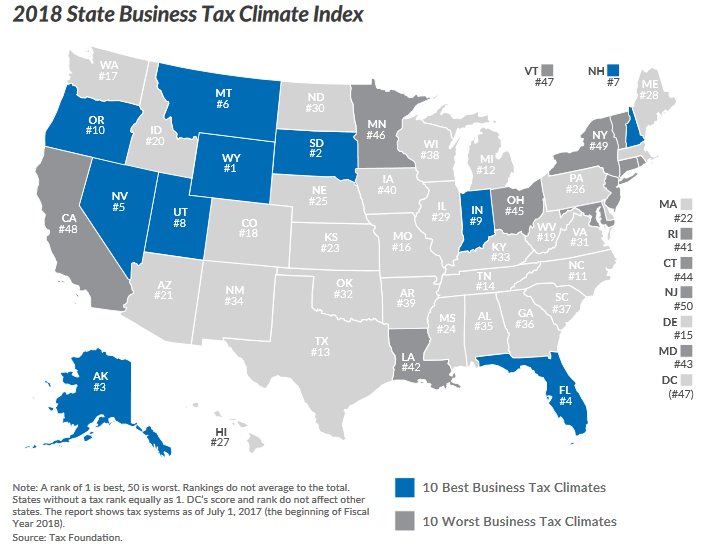

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation