open end credit is brainly

Credit card holders are known as convenience users when they. A high credit utilization ratio can make.

Compare Revolving Credit And Closed End Credit Brainly Com

Open-ended credit is extended in advance of any transaction so that the borrower.

. The total dollar amount you pay to. A line of credit generally arranged before the funds are actually required provides flexibility for the customer in that it ensures the ability to meet short-term cash needs as they arise. A credit arrangement in which a financial institution agrees to lend money to a customer up to a specified limit.

The difference between closed-end credit and open credit is mainly in the terms of the debt and the debt repayment. For example if a customer fails to repay an auto loan the bank may seize the vehicle as compensation for the default. In connection with credit secured by the consumers dwelling that does not meet the definition in section 2262a20 a creditor shall not structure a home-secured loan as an open-end plan to evade the requirements of section 22632.

Both open-end and closed-end loans can affect your credit score but closed-end loans are generally less dangerous for your credit. Open-end credit and Closed-end credit. A credit card charge.

A direct loan for personal purposes home improvements or vacation expenses is called. Common types of closed-end credit instruments include mortgages and car loans. Also called bank line credit line.

Describe how installment credit closed-end credit is different from open-ended revolving credit. To better understand open-end credit it helps to know what closed-end credit means. Also called bank line credit line.

Close-end credit is a credit arrangement in which the borrower must repay the amount owned plus interest in a specific number of equal plans usually monthly. The interest is usually tax deductible on a. Also called bank line credit line.

And iii the amount of credit that may be extended to the consumer during the term of the plan up to any limit set by. The effective annual rate of interest on a loan based on a specific calculation as set forth by law. A credit arrangement in which a financial institution agrees to lend money to a customer up to a specified limit.

Revolving credit which includes credit cards may be used for any purchase. A line of credit generally arranged before the funds are actually required provides flexibility for the customer in that it ensures the ability to meet short-term cash needs as they arise. An example of open-end credit is.

Therefore an open-end credit tends to attract a higher interest rate than secured loans from banks and credit unions Credit Union A credit union is a type of financial organization that is owned and governed by its members. Consumer credit - a line of credit extended for personal or household use. It most frequently covers a series of transactions in which case.

Fees and interest rates charged by the lender are the costs of these sorts of credit. A pre-approved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back prior to payments coming due. Open-end credit - a consumer credit line that can be used up to a certain limit or paid down at any time.

A credit card is an example of closed-end credit. False not borrowing a specific amount True or False. A department store credit card.

A Single lump sum of credit B An installment loan for purchasing furniture C A mortgage loan D A department store credit card E An automobile loan. The regulation carefully defines open-end credit as consumer credit extended under a plan in which i the creditor reasonably contemplates repeated transactions. Credit unions provide members with a variety of financial services including.

A line of credit generally arranged before the funds are actually required provides flexibility for the customer in that it ensures the ability to meet short-term cash needs as they arise. Open-end loans have a higher impact on your credit score particularly your credit utilization which refers to the ratio of how much credit is available to you and how much youre currently using. Which of the following is an example of open-end credit.

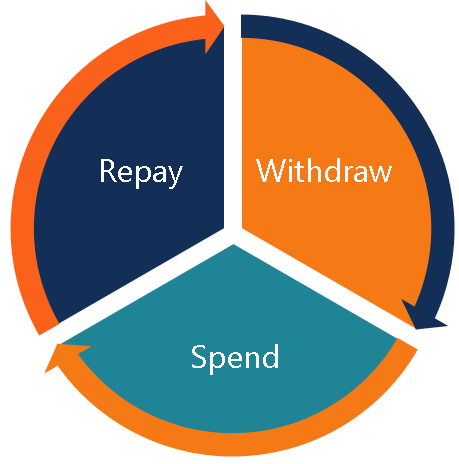

The credit is revolving in the sense that the line of credit remains open and can be used up to the maximum limit repeatedly as long as the borrower keeps paying a minimum monthly payment on time. Closed-end credit includes debt instruments that are acquired for a particular purpose and a set amount of time. The maximum borrowing power granted to a person from a financial institution.

Open-end credit is a line of credit that can be borrowed again and again as long as payments are completed on time and in accordance with the banks requirements. A home equity line of credit is an example of open-end credit. The pre-approved amount will be set out in the agreement between the lender and the borrower.

With a closed-end loan you borrow a specific amount of money for a. A credit arrangement in which a financial institution agrees to lend money to a customer up to a specified limit. Line of credit denotes a limit of credit extended by a bank to a customer who can avail himself or herself of its full extent in dealing with the bank but cannot exceed this limit.

Charge account credit account open account - credit extended by a business to a customer. Charge account credit revolving credit. B Prohibited acts or practices for dwelling-secured loans.

Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back prior to payments coming due. Open credit accounts are unsecured credit and no collateral is attached to them. Ii the creditor may impose a finance charge from time to time on an outstanding unpaid balance.

Annual Percentage Rate APR. Pay off their full balances due each month.

When Is A Long Term Purchase On A Credit Card Better Than Taking Out A Loan Brainly Com

Dylan Opened A Credit Card Account With 725 00 Of Available Credit Now That He Has Made Some Brainly Com

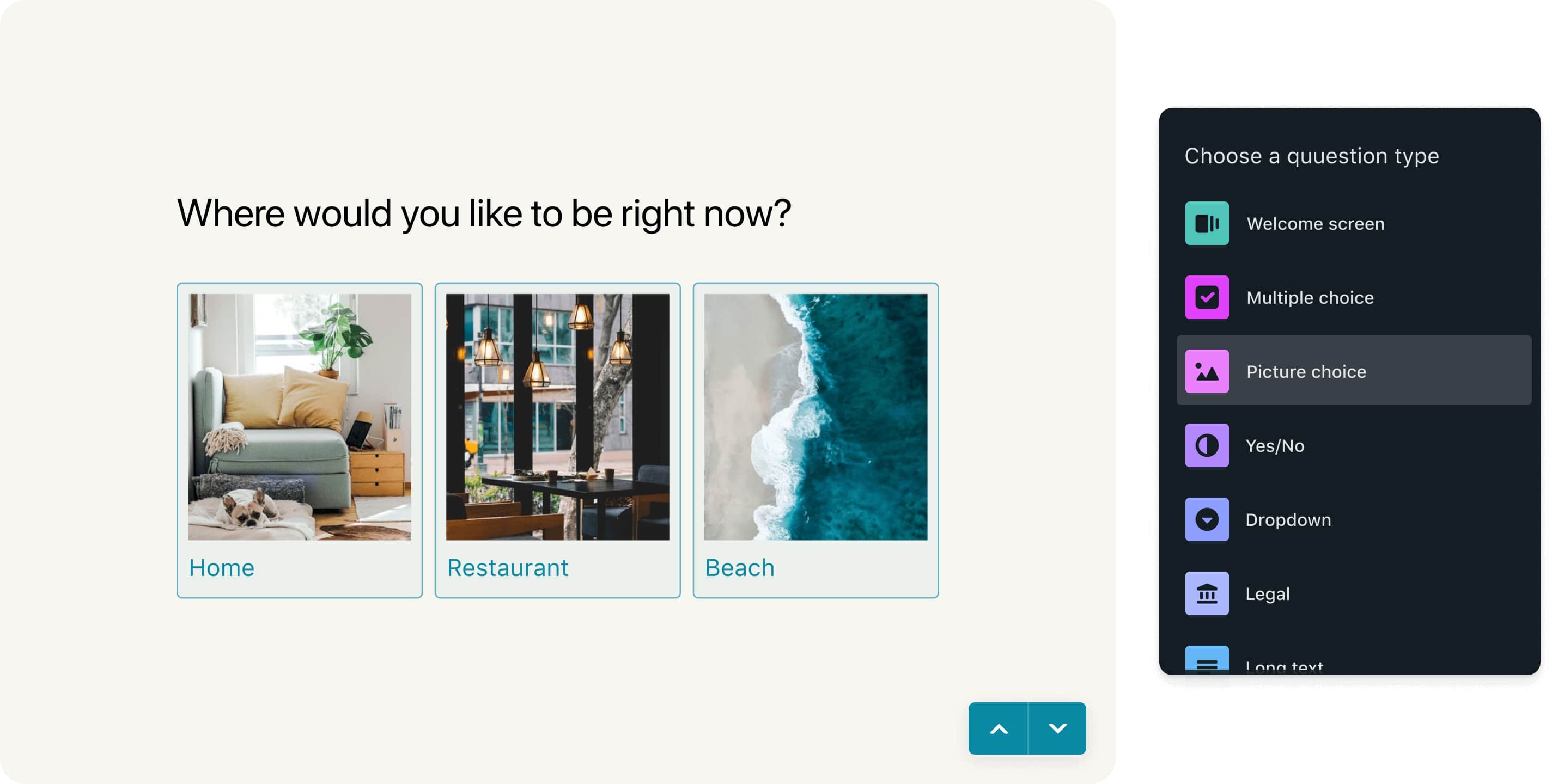

Good Survey Questions Examples Best Practices Tips Typeform

Which Is An Example Of Closed End Credit Payday Loan Title Loan Home Loan Credit Card Brainly Com

When Is A Long Term Purchase On A Credit Card Better Than Taking Out A Loan Brainly Com

Provide An Example Of A Open End Credit Account That Caroline Has Brainly Com

Which Of The Following Is Considered To Be Open End Credit A A Mortgage B A Car Loan C Brainly Com

What Is Open End Credit Brainly Com

Help Help Help Help Brainly Com

Match Each Type Of Lending Institution To Its Description Consumer Finance Company Credit Brainly Com

Types Of Credit Definitions Examples Questions

Type The Correct Answer In The Box Spell All Words Correctly What Role Does The Us Small Business Brainly Com

Understanding Different Types Of Credit Check Sort Each Scenario Into The Correct Category Based On Brainly Com

Which Of The Following Processes Is Most Likely To Have Smaller Atomic Nuclei As Reactants Brainly Com

Fiction Vs Nonfiction Venn Diagram Reading Classroom Reading Lessons School Reading

Plz Help What Is One Type Of Closed End Credit A A Credit Card B A Retail Credit Card C An Brainly Com

Figure Out The Costs Of Buying The Two Cars Listed Below By Filling In The Blanks In The Table You Brainly Com

/credit-f4fe7c4405754bdeb27a920bd8352dea.jpg)